|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

I Want Home Loan: A Step-by-Step Guide to Understanding Your OptionsSecuring a home loan can seem daunting, but with the right information, you can make an informed decision that suits your needs. This guide will walk you through the essential steps and considerations when you say, 'I want home loan.' Understanding Home LoansHome loans are financial instruments provided by lenders to help you purchase a property. They come with varying terms and conditions, depending on the lender and your financial profile. Types of Home Loans

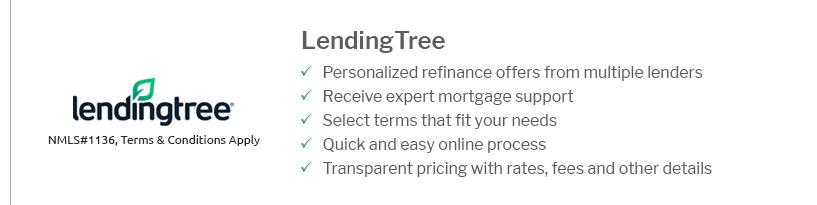

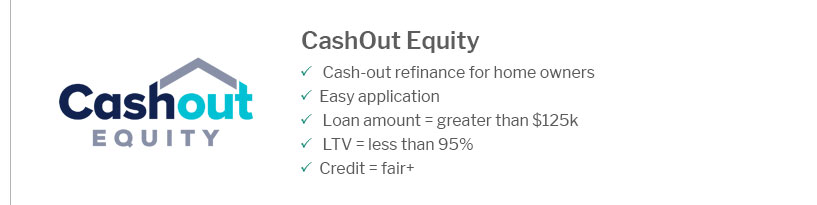

Steps to Apply for a Home LoanStep 1: Evaluate Your Financial HealthReview your credit score, debt-to-income ratio, and monthly budget to understand how much you can afford to borrow. Step 2: Research LendersConsider multiple lenders to compare offers. Look for competitive rates and favorable terms. A good place to start is exploring first home mortgage refinance rates to understand the current market. Step 3: Get Pre-ApprovedPre-approval strengthens your buying power and gives you a clear picture of your borrowing capacity. It involves a thorough check of your financial situation. Benefits of Home Loans

FAQs About Home LoansWhat is a good credit score to qualify for a home loan?Typically, a credit score of 620 or higher is needed for conventional loans, though higher scores can secure better rates and terms. How much should I save for a down payment?Conventional loans usually require a down payment of 20% of the home’s purchase price, though some programs offer options as low as 3%. Can I refinance my home loan?Yes, refinancing can lower your interest rate or change your loan term. It’s advisable to consider refinancing when rates drop or your financial situation improves. https://www.rocketmortgage.com/learn/types-of-mortgages

As a prospective home buyer, it's just as important to research types of mortgages as it I to look into the neighborhoods you want to live in. https://www.pnc.com/en/personal-banking/borrowing/home-lending.html

Looking for Help with an Existing Product or Want to Track an Application? https://www.huntington.com/Personal/Lending-comparison

Huntington offers a wide range of mortgage loan programs at competitive rates. Get Started - Learn More. "" Want to leverage the equity in your home?

|

|---|